Best Trade Finance Services for Small Businesses

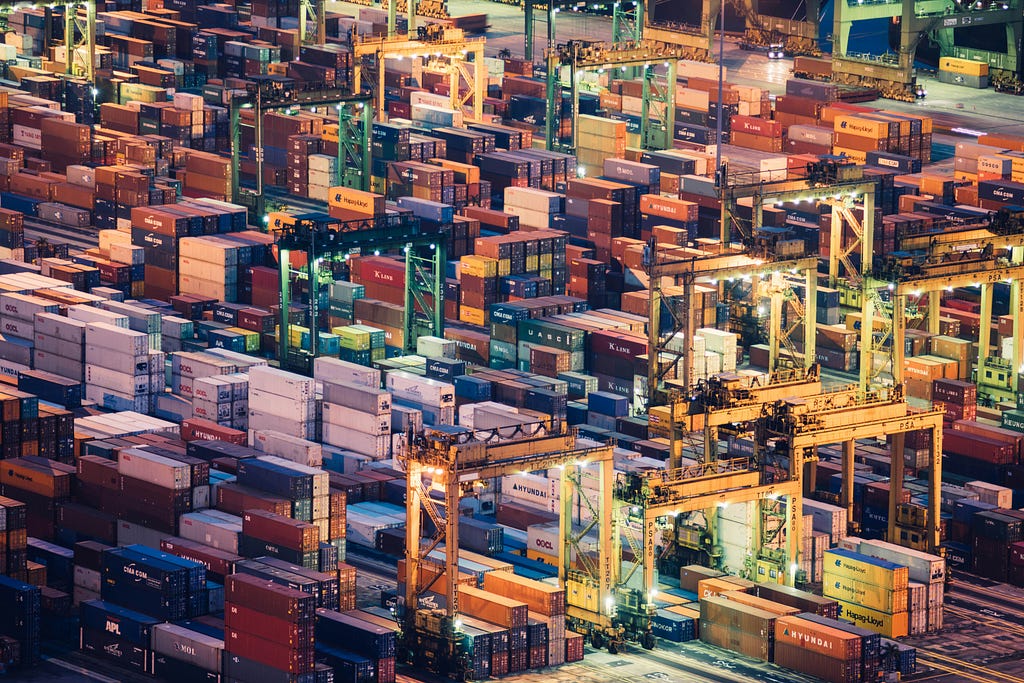

In an increasingly interconnected global economy, small businesses often find themselves needing to navigate the complex terrain of international trade. With the potential for growth by tapping into overseas markets comes the challenge of managing the financial risks and logistics associated with importing and exporting goods. This is where trade finance services step in, serving as the lifeblood for small enterprises looking to expand beyond domestic shores. Trade finance encompasses a range of financial instruments and products designed to facilitate international trade and mitigate risks such as currency fluctuations, non-payment, and political instability.

For small businesses, securing the right type of trade finance services can mean the difference between successfully executing overseas transactions and facing insurmountable hurdles. It’s not just about having the funds to purchase goods or raw materials; it’s also about maintaining cash flow, ensuring timely delivery, and safeguarding against international trade risks. A thorough understanding of trade finance terms, an assessment of financial needs, and a strategic approach to building relationships with lenders are crucial steps for small businesses looking to leverage these services effectively. Financial institutions offering trade finance options often tailor their solutions to meet the specific needs of small enterprises, ensuring that these businesses remain competitive on the global stage.

Key Takeaways

- Trade finance services are crucial for small businesses engaging in international trade to manage risks and logistics.

- Effective utilization of trade finance instruments can facilitate overseas transactions and help maintain cash flow.

- Small businesses must understand trade finance terms and foster strong relationships with financial institutions.

Understanding Trade Finance

Trade finance is a pivotal element for businesses engaging in international trade, providing the necessary financial support to optimize global operations.

Function and Scope of Trade Finance

Trade finance encompasses various financial instruments and products that companies leverage to facilitate international commerce. Its primary function is to mitigate the risks associated with global trade, including currency fluctuations, non-payment, and political instability. The scope of trade finance extends beyond merely providing funds; it includes letters of credit , export credit , and insurance services to safeguard transactions. Specifically, trade finance allows businesses, especially small businesses , to obtain a low-cost line of credit to purchase supplies , materials, and services necessary for expanding their operations internationally.

Role in Global Economy

The role of trade finance in the global economy is both significant and multifaceted. By facilitating smoother and more secure transactions, trade finance promotes global trade, which is a major engine for economic growth . It enables businesses to operate on an international scale by covering gaps such as shipping expenses and provides a framework for trust between trade partners in different countries. As a result, trade finance not only supports individual businesses in their growth endeavors but also contributes to the economic development of nations by bolstering international trade and commerce.

Trade Finance Products for Small Businesses

Small businesses aiming to navigate international trade can benefit greatly from specialized trade finance products. These solutions are designed to mitigate the risks associated with global transactions and to improve cash flow.

Letters of Credit

A Letter of Credit (LC) is a crucial financial tool for importers and exporters, particularly in transactions where the parties are dealing across borders and face uncertainties regarding payment. An LC serves as a guaranty from a bank that payment will be received by the seller as long as the terms specified in the credit are fulfilled. For small businesses, an LC can be pivotal in establishing trust with new trade partners.

Invoice Financing Options

Invoice financing allows businesses to advance funds against outstanding invoices, thus enhancing their working capital and cash flow. There are several forms of invoice financing, including factoring, where businesses sell their accounts receivable to a third party at a discount, and invoice discounting, where businesses use their unpaid invoices as collateral for a loan.

Export and Import Finance Solutions

For small businesses focused on export and import , tailored finance solutions are available to support their trade cycle. Export finance can include services such as pre-shipment finance to cover production costs, and import finance often involves instruments like trade loans used to finance the purchase of goods before their resale. Small businesses leverage these solutions to ensure they can fulfill orders and grow their operations without being hindered by cash flow restraints.

Evaluating Financing Needs

Before small businesses pursue trade finance, it’s critical to conduct a thorough evaluation of their financing needs. This includes understanding the working capital required to sustain operations and analyzing cash flow to ensure liquidity is maintained.

Working Capital Assessment

Working capital is the lifeblood of any small business, representing the capital that is readily available for day-to-day operations. An accurate assessment of working capital needs involves counting current assets against current liabilities. A positive working capital indicates a business has sufficient funds to meet its short-term obligations and invest in its operations.

- Calculation : Working Capital = Current Assets — Current Liabilities

Businesses must also consider the timing of cash inflows and outflows — payments from customers versus obligations to suppliers — to maintain smooth operations without unnecessary borrowing.

Cash Flow Analysis

Cash flow is a key indicator of a business’s financial health, especially for small enterprises looking to engage in trade finance. A cash flow analysis breaks down the money that comes in and goes out, highlighting periods of potential cash shortages or surpluses.

- Tools : Monthly Cash Flow Statement

- Objective : Ensure liquidity to fulfill orders and expansion plans

For small businesses, understanding their cash flow patterns helps them to make informed decisions about when to seek financing and what financing terms would align with their operational cycles. It’s crucial for businesses to project future cash flows to ensure they can honor trade finance obligations without disrupting their operations.

Assessment of Risk in Trade Finance

When engaging in international trade, small businesses must navigate a complex landscape of financial risks. Effective risk assessment is crucial to maintain the resilience and profitability of trade operations.

Payment Risk Management

Payment risk , also known as credit risk or counterparty risk , refers to the potential that a buyer may default on their payment obligations. Managing this risk begins with due diligence on the counterparties involved. Letters of credit serve as a robust instrument, providing assurance that payment will be made provided that the trade terms are met. Mitigating payment risk often entails structuring transactions with trade credit insurance to safeguard against the event of non-payment . Optimizing interest rates tied to trade finance products can also offset costs associated with these risks.

Currency and Political Risks

Trade finance also exposes small businesses to currency risks caused by exchange rate changes , which can affect the cost of transactions and ultimately impact profitability. Utilizing hedging strategies such as forward contracts can lock in exchange rates and provide stability against market volatility. Alongside currency risk, political risk is an omnipresent factor for global trade, encompassing changes in political stability, legislation, and regulatory environments that affect the execution of international transactions. Strategies for dealing with these types of risks include thorough research into the political landscape and embracing flexible financing solutions that can adapt to sudden changes.

Securing Trade Finance

When it comes to trade finance , small businesses must navigate a comprehensive application process and understand the required qualifications . Adequate preparation of collateral and arranging for necessary insurance can be vital in obtaining the financial support needed.

Application Process and Qualifications

Small businesses seeking trade finance will need to prepare a detailed application. This application typically requires them to demonstrate creditworthiness , provide financial statements, and outline their business plan . Qualifications may vary by lender, but they often look for a proven track record in business, a solid credit history, and potential for market growth. Small businesses must also be prepared to provide information about their export or import activities and evidence of orders or contracts that necessitate the financing.

Collateral and Insurance

Lenders generally require collateral to secure trade finance loans, which may include assets such as inventory, accounts receivable, or even personal assets. In addition, insurance plays a critical role in managing risks associated with international trade. Businesses should secure trade credit insurance to protect against non-payment by foreign buyers and consider cargo insurance to safeguard goods in transit. These instruments not only provide lenders with additional security but also grant the business owner peace of mind that financial support will not lead to undue exposure.

Trade Finance Services by Financial Institutions

Financial institutions offer a range of trade finance services that are vital for small businesses looking to expand their operations internationally. These services are designed to mitigate the risks associated with global trade, such as currency fluctuations and non-payment.

Banks and Non-Bank Lenders

Banks are traditionally the most common providers of trade finance services. They offer products such as letters of credit and bank guarantees , which assure payment and help facilitate trust between trading partners. Commercial banks , ranging from local to global operators, often have specialized trade finance departments that understand the intricacies of cross-border transactions.

Non-bank lenders also play a role in this space, offering more flexible or niche financing solutions that may not be available from traditional banks. Their services can often be tailored to fit the specific needs of small businesses and they can sometimes provide quicker access to funding.

Fintech Alternatives

The advent of fintech has introduced innovative trade finance software solutions to the market, disrupting traditional models with technology-driven services. Fintech companies leverage digital platforms to streamline the application and funding process, making trade finance more accessible for small businesses.

Furthermore, innovation in the form of blockchain technology is being explored as a way to secure transactions and simplify the documentation process involved in trade finance. Such cutting-edge developments have the potential to reduce costs, increase efficiency, and enhance transparency in global trade.

Understanding Terms and Conditions

When evaluating the best trade finance services, small businesses must pay close attention to the specific terms and conditions that will govern their financial agreements. Interest rates and repayment periods, along with fees and charges, are crucial aspects that directly affect the cost and suitability of trade finance options.

Interest Rates and Repayment Periods

Interest rates determine the cost of borrowing and are expressed as a percentage of the principal loan amount. They may vary depending on factors such as the level of risk and the length of the repayment period. Repayment periods , on the other hand, define the time frame in which the small businesses must repay the loan. It is imperative that businesses understand the schedule — whether payments are due monthly, quarterly, or on another basis, to manage their cash flows effectively.

- Interest Rates : Typically, trade finance loans offer competitive rates, but these can vary widely among lenders.

- Repayment Periods : Repayment terms can range from a few weeks to several years, depending on the type of financing and the lender’s policies.

Fees and Charges

In addition to interest rates, businesses should also be well-informed about any fees and charges that may apply. These could include:

- Setup fees : One-time fees charged when setting up the financing agreement.

- Service charges : Ongoing costs for the management of the account.

- Early repayment fees : Charges that may apply if the business pays off the loan before the end of the agreed term.

- Late payment fees : Additional costs incurred if the business fails to meet the repayment schedule.

Understanding these fees and how they are structured will help businesses anticipate the true cost of their trade finance service.

Building Relationships with Lenders

For small business owners, establishing a strong rapport with lenders can be the cornerstone of accessing vital trade finance services. These relationships are instrumental in facilitating lending for corporate clients and traders. It is critical to navigate the ‘Know Your Customer’ (KYC) protocols and communicate financial needs effectively.

Networking with Bankers

Networking with bankers is not merely about exchanging business cards; it’s an investment in future financial support and advice. Small business owners should actively participate in local business events and banking workshops. This involvement demonstrates a commitment to the financial community and puts a face to the business. By doing so, they increase their visibility to potential lenders and stay informed on the latest financial services that could benefit their trade operations. Networking efforts should be strategic and focused:

- Attend banking seminars and business finance fairs.

- Join local chamber of commerce meetings to meet regional bankers.

- Engage with bank representatives through social media platforms.

Effective Communication with Financiers

When communicating with financiers, clarity and transparency are paramount. Small business owners must effectively convey their business plans, financial state, and how they intend to use and repay borrowed funds. This level of communication fosters trust and positions the business as a credible corporate client. Here are some best practices for communication:

- Prepare thorough financial statements: Accurate documentation of cash flows, debts, and assets.

- Articulate a clear business strategy: Highlight specific use of funds and potential for growth.

- Adhere to KYC requirements: Provide all necessary documentation to comply with KYC regulations and streamline the lending process.

Effective communication and proactive networking lay a firm foundation for strong lending relationships that support small businesses in their trade finance endeavors.

Regulatory Compliance and Documentation

Ensuring regulatory compliance and accurate documentation is essential for small businesses involved in trade finance. These measures mitigate legal risks and enhance trust with financial institutions and trade partners.

KYC and Anti-Money Laundering Requirements

Know Your Customer (KYC) policies are a critical component of trade finance operations. They require businesses to verify the identity of their clients, understand the nature of their work, and assess potential risks of illegal intentions for the business relationship. Anti-Money Laundering (AML) standards complement KYC by preventing the practice of income generation through illegal actions. Small businesses must adhere to these regulations to maintain access to trade credit and other financial services.

- Identification of clients : Collect official identification documents.

- Purpose and intended nature of business relationships : Document and keep records of the business rationale.

- Ongoing monitoring of transactions : Establish a process for consistent oversight.

Trade Documentation and Compliance

Trade documentation encompasses a wide range of paperwork necessary for international trade, ensuring compliance with local and international laws. Accurately completed documents facilitate documentary collections , a common method of trade settlement that mediates between buyer and seller through their respective banks.

- Document list and verification : Ensure all required documents such as commercial invoices, bills of lading, and certificates of origin are accurately filled out and verified.

- Regulatory adherence : Confirm that all documents comply with the regulations of the countries involved in the transaction.

- Record-keeping : Maintain organized records for all trade transactions to streamline compliance checks and audits.

Emerging Trends in Trade Finance

Trade finance is experiencing a transformative shift with the integration of cutting-edge technologies. These advancements are specifically designed to address the complexities small businesses face in international trade.

Digitalization and Automation

The role of digitalization in trade finance has become pivotal, making transactions faster and more efficient. Trade finance software is increasingly adopting machine learning algorithms to enhance decision-making and risk assessment. For instance, machine learning models are used to predict cash flow patterns and detect anomalies in transactions, significantly reducing the risk of fraud.

Automation powered by digital technologies is also streamlining documentation processes, enabling small businesses to focus on their core operations rather than on paperwork. Automating these workflows leads to reduced errors and improved turnaround times. Thus, the incorporation of digital solutions is essential for staying competitive in a rapidly evolving market.

Innovative Financial Products

Innovative financial products are emerging as a response to the unique challenges faced by small businesses in trade finance. The use of blockchain technology is gaining traction due to its ability to provide secure, immutable transactions. Blockchain is fostering trust among trading parties, which is crucial in a landscape where traditional financing methods can be cumbersome.

New financing models are being developed to improve SMEs’ access to capital. For example, receivables financing and dynamic discounting platforms are allowing businesses to manage their cash flows more effectively. The continued innovation in trade finance products is likely to unlock new opportunities for small businesses, facilitating global trade on an unprecedented scale.

Trade Finance Support for Growth

Trade finance services are pivotal in empowering small businesses to scale up operations, secure competitive positioning, and pursue strategic investments for long-term growth. These financial instruments align with businesses’ expansion goals while mitigating the risks associated with international trade.

Enhancing Competitive Advantage

Access to trade finance allows businesses to compete on a global scale, wherein export financing plays a crucial role. It enables small businesses to fulfill larger orders, often leading to bulk purchase discounts and improved profit margins. With the backing of the Small Business Administration (SBA)’s export financing programs, companies can safely navigate international trade markets, extend more attractive payment terms to buyers, and ultimately increase their market share.

Strategic Investment and Expansion

For sustained growth, small businesses must focus on their investment strategy . Trade finance fuels this by providing the capital necessary to invest in new technologies, enter new markets, and upgrade facilities. The strategic use of trade finance aligns with businesses’ growth trajectories, ensuring that investment decisions are not bottlenecked by cash flow constraints. Ultimately, these calculated investments catalyze long-term operational expansion, which is essential for a small business’s evolution into a competitive force in the international arena.

Frequently Asked Questions

In addressing common inquiries, this section provides clarity on the vital aspects of trade finance services beneficial for small businesses and how to access them effectively.

What are the key features to look for in a trade finance provider for small businesses?

When selecting a trade finance provider , small businesses should prioritize flexible repayment terms, a comprehensive range of financial instruments, and the provider’s experience in handling international trade complexities.

How does Bank of America’s trade finance services compare to other major banks?

Bank of America’s trade finance services are considered competitive, offering small businesses resources and global transaction capabilities similar to other major financial institutions, with a strong focus on technological integration and customer support.

What are the potential benefits of using sustainable supply chain finance for small businesses?

Small businesses may find sustainable supply chain finance appealing as it can lead to cost savings through efficient practices and enhance their market reputation by aligning with environmental and social governance criteria.

How can small businesses benefit from Bank of America’s global transaction services?

By utilizing Bank of America’s global transaction services , small enterprises can streamline their international transactions, manage risks associated with foreign exchange, and improve working capital efficiency.

What are the steps for a small business to get started with trade finance through a provider like Bank of America?

To begin with trade finance through a provider like Bank of America, small businesses usually need to establish a relationship with the bank, undergo a credit assessment, and provide detailed information about their trading activities and requirements.

What are the typical terms and conditions associated with trade finance services for small enterprises?

Typical terms and conditions for trade finance services may include stipulations on the types of goods or services eligible for financing, repayment schedules, interest rates, and specific documentation for the transactions involved.

Get Started With Us

Submit Your Deal & Receive a Proposal Within 1-3 Working Days

Submit your deal using our secure intake form, and receive a quote within 1-3 business days. Existing clients can connect with their relationship manager through our secure web portal.

All submissions are

promptly reviewed, and all communications are conducted through the intake form or the client portal for a seamless and secure process.

Thank you for considering working with us. A nominal fee of US$500 is required upon completion of each form. This fee covers the time and effort we invest in reviewing your submission and crafting a thorough proposal. We receive numerous inquiries and prioritize those that carry this fee, ensuring serious applicants receive prompt attention.

Trade Finance

Tap into solutions like letters of credit, bank guarantees, and payment facilitation. We address the challenge of global transaction risk through structured strategies that foster cross-border growth. Complete the form to unlock streamlined funding aligned with your commercial objectives.

Submit a RequestProject Finance

Access non-recourse funding for infrastructure, renewable energy, or other capital-intensive ventures. We mitigate capital constraints by isolating project assets and focusing on risk management. Provide your details to receive a structure that drives growth and maximizes returns.

Submit a RequestAcquisitions

Secure financing for business or real estate acquisitions. We ease transaction hurdles by reviewing cash flow, synergy opportunities, and exit plans. Complete the form for a customized proposal that supports your strategic investment objectives.

Submit a RequestFor Banks

Financely assists banks facing Basel III pressures by distributing trade finance deals and providing collateral for letters of credit. We reduce capital burdens while preserving client relationships and fostering service expansion. Submit your request to optimize your trade finance offerings.

Submit a RequestOnce we receive your submission, our team will review your information to determine feasibility. If eligible, you will receive a proposal or term sheet within 1–3 business days. Visit our FAQ and Procedure pages for more information.

Disclaimer: Financely provides financing based on due diligence and feasibility. Approval is not guaranteed, and past performance does not predict future outcomes. All terms are subject to review. Financely primarily assists with structuring and distribution. Qualified parties carry out the project if the client approves the proposal.